property tax assistance program illinois

Aand information on financial assistance programs for elderly Illinois residents is available here. Ad Take Charge Of Your Tax Problem.

Older Illinoisans Have More Options For Property Tax Relief Under Murphy Law

Pritzker Administration Announces 309 Million Assistance Program for Illinois Homeowners Impacted by COVID-19.

. Your household income from all sources for the prior year must be below. Every property owner can get an income tax credit of up to 5 of property taxes paid. Illinois offers a competitive range of incentives for locating and expanding your business including tax credits and exemptions that encourage business.

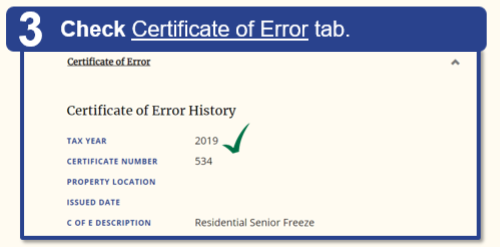

Ad See If You Qualify For IRS Fresh Start Program. Senior Citizens Property Tax AssistanceSenior Freeze. The Program will provide 560 million in property tax relief and 453 million in pharmaceutical assistance to Illinois senior citizens.

The Illinois Homeowner Assistance Fund ILHAF is a federally funded program dedicated to assisting homeowners who are at risk of default foreclosure or displacement as result of a. CAAs may partner with local. To see if you qualify give us a call.

Beginning January 1 2001 legislation will take effect that. Find Out Now If You Qualify. Ad See If You Qualify For IRS Fresh Start Program.

It is managed by the local governments including cities counties and taxing districts. Senior Citizens Real Estate Tax Deferral Program This program allows persons 65 years of age and older to defer all or part of the real estate taxes and special assessments up to a. The County Board decided against delaying the collection.

Ad Get Assistance for Rent Utilities Education Housing and More. The Illinois Department of Revenue does not administer property tax. Federal funding is provided to Illinois 36 Community Action Agencies to deliver locally designed programs and services for low-income individuals and families.

Do You Need To Set Up An Illinois State Installment Plan. The state of Illinois is providing a property tax rebate in an amount equal to the lesser of the property tax credit you could qualify for 2020 property taxes payable in 2021 or 30000. Get Funding For Rent Utilities Housing Education Disability and More.

Based On Circumstances You May Already Qualify For Tax Relief. The Illinois Rental Payment Program ILRPP provides financial assistance for rent to income-eligible Illinois renters and their landlords who have been impacted by the COVID-19 pandemic. We have funds available for delinquent taxes on a first come first served basis and assistance can only be given to one property per Illinois homeowner.

Property Tax Assistance Will County Illinois How to Apply Applications are taken Monday through Friday from 8am 3pm on a walk-in basis. Get All Of Your Tax Questions Answered. There is also a loan program to help homeowners who are 65 by June 1 of the relevant tax year.

I recommend that you visit the Illinois Property Tax Appeal Board Taxpayer Assistance. If you are a. You can use the Illinois Property Tax Credit on your income tax return.

This credit equals five percent of the Illinois. Based On Circumstances You May Already Qualify For Tax Relief. The City of Chicago Property Tax Rebate Program provides working- and middle-class families and seniors some property tax relief through a City-funded rebate.

The Illinois Property Tax Credit Can Help You Reduce Your Taxes. Lake County property owners will receive their property tax bills as scheduled and be expected to pay them by June 8. Provide a property tax rebate up to 300.

31 rows Purpose of the Property Tax Relief Program. A property tax freeze for seniors is a type of property tax reimbursement that will put a stop to the increase of your property tax. A limited number of applications are taken each.

Find Out If You Qualify. Free Case Review Begin Online. Compare Expert Tax Companies Online Today.

Single filers earning less than 250000. Homeowners can apply for up to 30000 in assistance at. Ad Do You Need To Set Up An Illinois State Payment Plan.

Available here The Circuit Breaker Property Tax Relief program provides. INCENTIVES AND TAX ASSISTANCE. There may be some assistance available for delinquent property taxes in Winnebago County Illinois.

Free Case Review Begin Online. Compare Ratings For Tax Companies Online Today.

My Specialization Is In Irs And Illinois Department Of Revenue Tax Problems I Represent Many Individuals And Businesses Tax Lawyer Business Tax Tax Attorney

If You Find The Tax Amount For Your Residential Asset Is A Bit Too High Then You Always Have The R Property Investor Real Estate Investor Top Mortgage Lenders

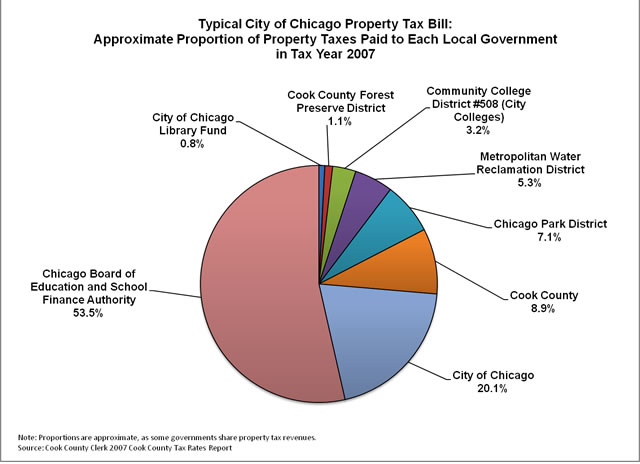

Where Do Your Property Tax Dollars Go The Civic Federation

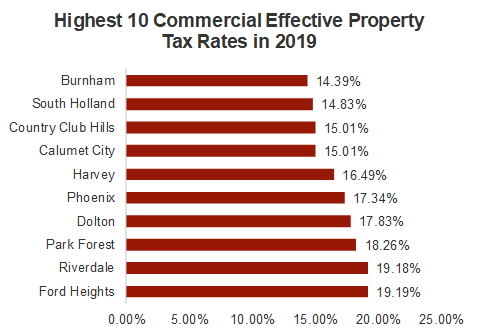

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

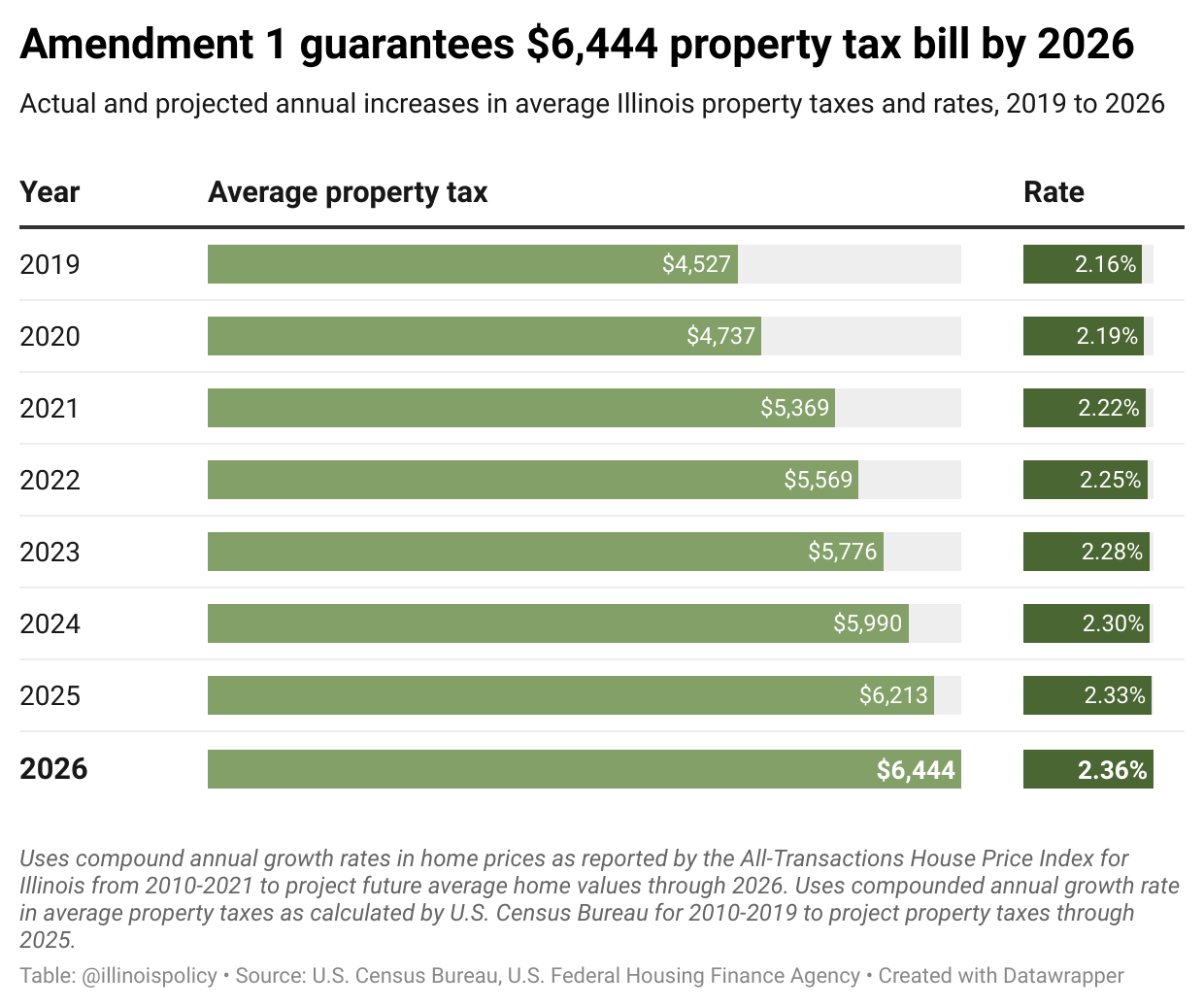

Ep 44 How Amendment 1 Would Raise Your Property Taxes

Illinois Property Tax Exemptions What S Available Credit Karma

Pritzker To Offer Relief On Groceries Gas Property Taxes

Illinois Family Relief Plan Explained Wics

2021 Property Tax Bill Assistance Cook County Assessor S Office

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Direct Relief Coming To Illinoisans Starting July 1

The Perfect Storm 2021 Property Taxes And Chicago Community Associations The Ksn Blog

Property Tax City Of Decatur Il

Credit Repair Newsletter Asap Credit Repair Usa Reviews Credit Repair Specialist Course Asap Cred Rebuilding Credit Credit Repair Companies Good Credit

Illinois Income And Property Tax Rebate Distribution Begins Next Month Here S How Much Relief You Could Be Eligible For Nbc Chicago

2021 Property Tax Bill Assistance Cook County Assessor S Office

Governor Pritzker Presents 2023 Budget Including Property Tax Rebates Chicago Association Of Realtors